Something came up this weekend and made me change the way I parent. It wasn’t something new, but it was the final straw. I’d had enough and things were going to be different.

My oldest daughter was having trouble finding something to wear for church, and she was searching in a closet full of beautiful dresses. Dresses, she picked out, and I purchased for her with a very limited family clothing budget. She was close to melting down and yes, it was about more than a dress. It was also about cooking the perfect Mother’s day meal and making the perfect Mother’s day surprise. Plus knowing that her boyfriend’s parents were coming over to join our Mother’s day celebration and wanting to make a good impression. It was about singing in the choir loft where the whole congregation could see her, and taking on the stress of trying to be an adult when she isn’t quite there yet. (I feel like I need to tell you that I was helping her with the meal and everything else, which just seemed to make her more upset, because she WANTED to do it all by herself to make a very special day for me.) It all added up and equaled “nothing to wear.” I hope other Moms of teenage daughters can verify that this is normal.

It wasn’t an isolated situation and it wasn’t limited to her. Her sister a few weeks ago, begged for a reasonably priced pair of jeans at Costco. You can’t try things on there, but their return policy is excellent as long as you leave the tags on. She cut the tags before trying them on only to discover they didn’t fit. I was panicked. “Let your sister try them on.” They didn’t fit her either.

“Calm down, Mom.” They said. “We’ll sell them. It will be fine.”

“What do you think you could get for them?”

“$1-2.” They looked happy. “Then we’ll use the money to buy jeans that do fit.”

I said, “I bought brand new jeans for $12 and you are going to turn around and sell them for $2?” They were cheap jeans from the get-go….but still. This is bad math. I had to leave the room before I said anything more. The air was thick with my frustration.

I’ve noticed a pattern that when I buy their clothes for them, the items end up in the garage sale pile much too soon. Or relegated to the “nothing to wear” section of the closet. Or just tossed on the floor and trampled on. I tried to prevent it by asking them lots of questions in the store: “Is it too tight?” “Is it comfortable?” “Do you like the way it looks from the back?” “Are you SURE you are going to wear this?” They promise they will, but then don’t. Sometimes I think all my questions just sowed seeds of doubt that blossomed into full grown confidence busters once the clothing gets home. Parenting is so hard. Being a teenager is hard too.

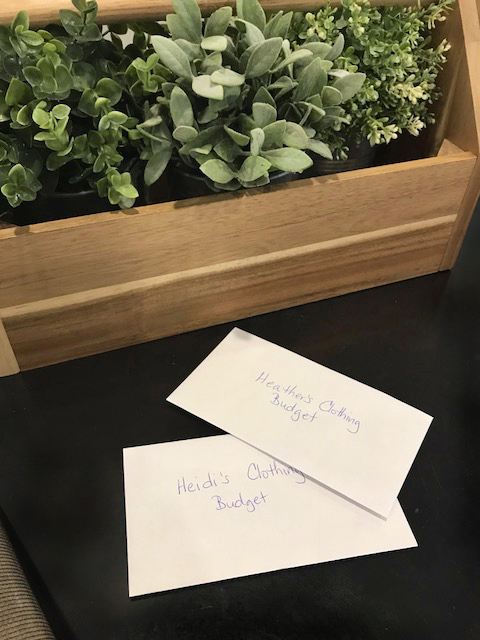

The best solution I could find is to turn it all over to them. I handed them each an envelope with their portion of the monthly clothing budget in it. It’s $20. In June they will get $20 more and so on. That $20 will make the $12 pair of jeans look a lot different in a few months. Right now, they feel rich. They said, “Oh Thank you! That’s so generous of you!”

I didn’t feel very generous. I reminded them, “That will have to cover your underwear, bras and socks. Swimwear, school clothes, formal wear, shoes.”

“Yes! We understand.”

“You can save it from month to month until you have enough to do something with.”

“Yes, Mama.”

They know the glories of thrift stores and garage sales, and we recently discovered a lovely consignment store near us as well. Perhaps they will discover the joys of selling to the stores as well as shopping there. Perhaps they will learn about Ebay or Craigslist. Perhaps they will learn to sew. I’m not sure. It’s up to them now, and I’m kind of excited to see what they do with it.

P.S. While this feels like the perfect solution right now, it was really hard for me to do, because I’ve never divided the budget evenly among the family members. I always used the money in a lump sum for the people who have immediate needs, like athletic shoes or longer pants, and fill in the gaps with hand-me-downs from brother to brother. Now my lump sum is $40 smaller each month, but I think the educational experience will be worth any kind of adjusting I need to do on my end.