I want to introduce you to a long time friend, Jennifer Dickson. She and her husband, Andrew, are risking everything to change the world for YOU. Their dream for you is to never owe another utility bill and to live in a paid for house so you can spend your income and your time with your family. With that introduction, I’m going to let her tell you more:

It was a typical morning last summer when I, pregnant and late to work (where I’d recently been told it would be unlikely for me to reduce my 50+ hour work weeks once baby #2 arrived), backed our 10-year-old car into our 15-year-old car. After working through lunch and spending the customary two hours of family time with our toddler that evening, my husband and I agreed that something had to change. But how could we make a drastic career shift and still pay the mortgage?

A quick survey of most any family budget will reveal that the biggest monthly expense is housing and housing-related costs. We take it for granted that mortgage debt is a part of life, and that utility costs will always rise. But it hasn’t always been this way!

In the past 50 years the American home has doubled in size, energy consumption and percentage of income. While families used to spend 17% of their income on housing, we now spend 35% – and that’s at all income levels, and despite a growing number of two-income families. It seems that as soon as we start to get ahead of housing expenses, we go shopping for a bigger model!

It’s no wonder so many of us can relate to feeling “house poor.” On an individual level this translates to less time, less disposable income and less flexibility to pursue, say, a different career, a new venture, a missionary opportunity or a travel experience. At the national scale we’re drowning under nearly $12 trillion of mortgage debt, with growing numbers of the population priced out of the housing market altogether.

This is what led my husband, an industrial designer and interior architect, and me, an architect, to found Acre Designs. We are a startup creating NetZero homes – meaning homes with NO energy bills – for the same cost as traditional construction. We are able to build in about half the time of a standard house, using super-insulated panelized walls and roofs that install in a few short days. Acre homes require a fraction of the typical mechanical and electrical systems, and we make up the remainder with a small solar PV system, allowing the homes to produce as much energy as they consume.

Grocery Shrink readers already understand the power of controlling food costs. Imagine the life that opens up when you can control housing costs as well! We think everyone should be able to expect more from their biggest investment, and Acre homes make that possible.

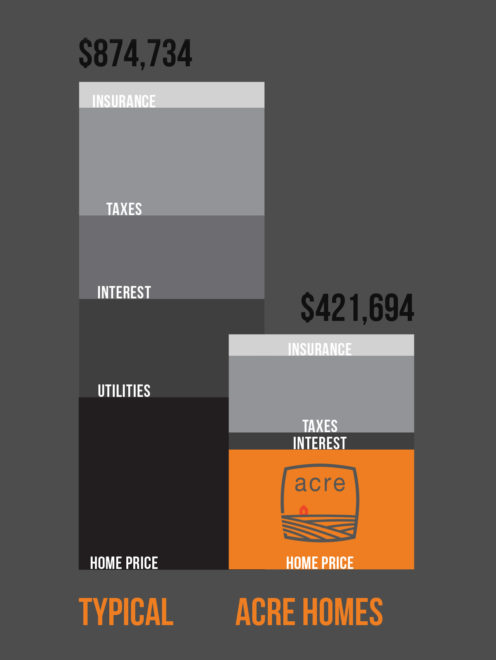

The average homeowner will save $250-300 each month on energy bills. If those savings are applied toward an accelerated mortgage, the savings are astronomical – well over $400,000 over the life of a typical 30-year mortgage! This is a game-changer for most families, and it’s a solution that’s currently unavailable on the market.

To make all of this possible, we’re fixing problems throughout the entire design and construction industry. Currently building in Kansas City, next year we’ll begin to integrate online tools with a network of builders, allowing us to build Acre homes throughout the country.

Step 1 is to build our NetZero prototype, the Axiom House, in Kansas City. We will use it to demonstrate and document Acre’s revolutionary construction processes, sensors to collect data on actual home energy performance, and the budget to prove we can build at an affordable pricepoint. We’re currently crowdfunding on Indiegogo to make the prototype project possible – visit our campaign, donate and share today! Each backer can choose from several great rewards, and will help us bring this revolutionary solution to market!

Learn more, and back our campaign, at www.acredesigns.com.

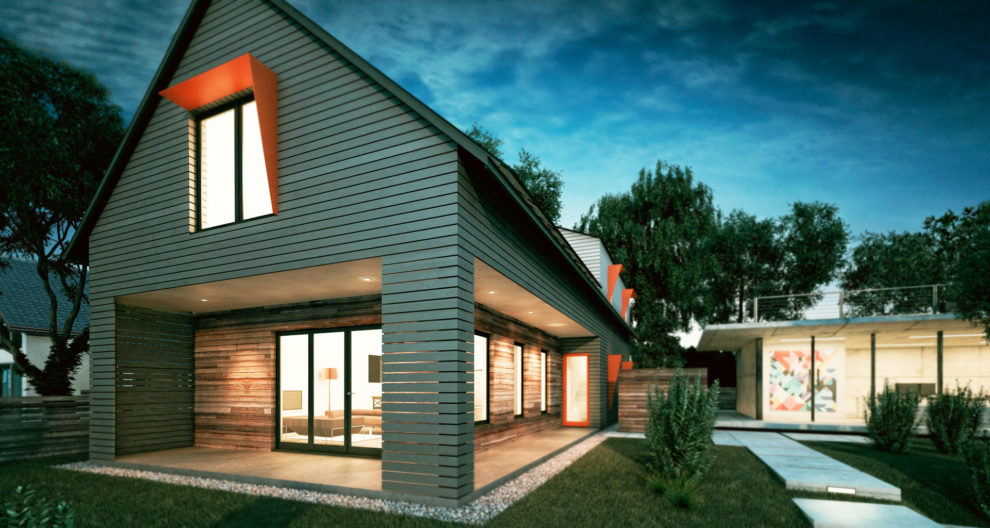

P.S. Angela here–These pics show some of their modern versions of homes, but they have all styles including log cabin and more traditional looking homes.

So cool! I would be interested in looking at these if we are ready to build sometime in the next few years.

Thanks for sharing our story, Angela, and for being an advocate for our company!

Super interesting! I’m going to show this to my husband.

Yes! They should be in your area around the time you’re ready to build.

This is very cool! We’re in Canada… but would love to see an option like this here someday.

I can’t wait to hear more and see more! What a great idea.

Those homes look super cool. I like the idea of low/ no utility bills. But then again, I live in Coastal California, so we are already pretty close to that. We’ve considered solar, but our utility bills (gas/ electric) are generally less than $75 a month. Total.

Wow! Those are great utility bills. Ours are around $400 a month, BUT we did get a 5,000 square foot house in a great neighborhood for $140,000. It probably all averages out.