One of the lowest cost food categories is soup. Soup is mostly water but still filling and comforting. I love that soup is a meal in one, saving prep time and money on side dishes. I usually add a hearty bread for the men, but skip it myself to stay on track with my fitness plan.

Recently the weather has turned super cold and white, so we’ve been enjoying night after night of various soups. Is there a limit on how many days in a row one can serve soup? I don’t think so–that would be like saying there was a limit on the number of days in a row you could eat pizza. Crazy.

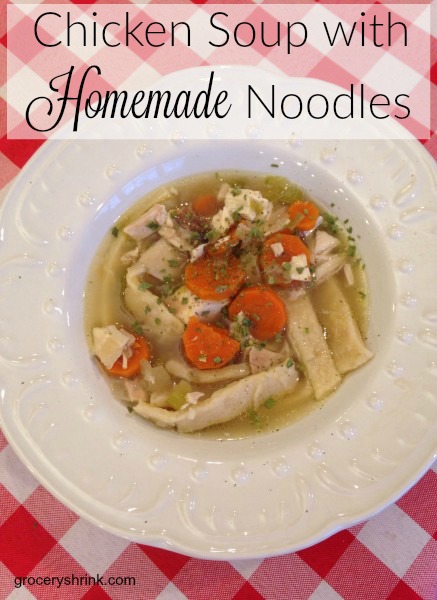

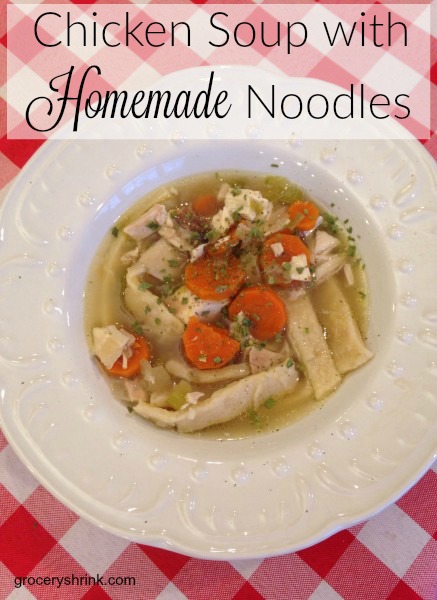

I posted this photo on instagram and got a couple of requests for the recipe. My husband’s sisters made this soup for the family when they were growing up and the first time I tasted it, I begged the recipe from them. It’s the perfect thing for a crowd or when someone isn’t feeling well. Full of rich bone broth, it’s soothing and healing. When someone is suffering and I feel powerless to help, I make soup!

Homemade Chicken Noodle Soup

1 whole roasting chicken (4-5 lbs)

12 cups water

5 tsp mineral sea salt (you can use less, but we go for 1 tsp per quart of food/liquid)

1 tsp garlic powder

1 tsp fresh black pepper

6 carrots, peeled and sliced

4 stalks of celery, chopped

1 onion chopped (I had red on hand, but any kind will work)

Combine everything in a large pot and bring to a boil. Reduce heat to a simmer and simmer for about an hour or until the chicken is falling apart. If your chicken was frozen, allow 2.5-3 hours to cook.

Remove chicken and bones to a bowl to cool enough to touch. Skim any foam off the top of the broth and discard.

Use a slotted spoon or spider to remove vegetables to a second bowl.

Remove meat from bones and chop. Store meat with the vegetables in the bowl.

Keep a bowl of water close for re-wetting your hands as you work with the noodle dough. This will keep it from sticking.

For noodles combine:

2 cups of unbleached flour

1 tsp salt

2 tsp olive oil

2 eggs

4 Tbs water

Knead everything with damp hands then roll out 1/4 inch thick. Dough should be dry and barely hold together. Cut with a pizza cutter into strips about 3/8 inch wide and 2-3 inches long. Bring the chicken broth to a full rolling boil and drop the noodles in. Separate with a spoon when they first go in. Boil for 15 minutes then turn off the heat. Return vegetables and chicken back to the soup and sprinkle the top with dried parsley. Don’t skimp on the parsley–it makes it so pretty and appetizing.

The average family of 8 spends between $1200-$1600 a month on food. We spend $620 ($550 for groceries, $40 for eating out and $30 for lunch allowance for my husband.) A difference of $580-$980 a month. That means over a year we are saving $6,960-$11,760. We have been living this way for more than 10 years for a cumulative savings of $69,600-$117,600. Around here, that’s enough to pay cash for a modest house.

The average family of 8 spends between $1200-$1600 a month on food. We spend $620 ($550 for groceries, $40 for eating out and $30 for lunch allowance for my husband.) A difference of $580-$980 a month. That means over a year we are saving $6,960-$11,760. We have been living this way for more than 10 years for a cumulative savings of $69,600-$117,600. Around here, that’s enough to pay cash for a modest house.